Social media is an essential part of our lives. It connects us with loved ones and friends, keeps us up to date with the latest news and trends, and even lets companies conduct business. Unfortunately, our social media connections have also become a hub for fraudulent activity and scams.

As social media continues to grow, so do the tactics of scammers who see these platforms as fertile ground for their schemes. One particularly dangerous scam targeting younger adults involves the use of fake checks—an old trick that has found new life in this digital age.

How Fake Check Scams Work on Social Media

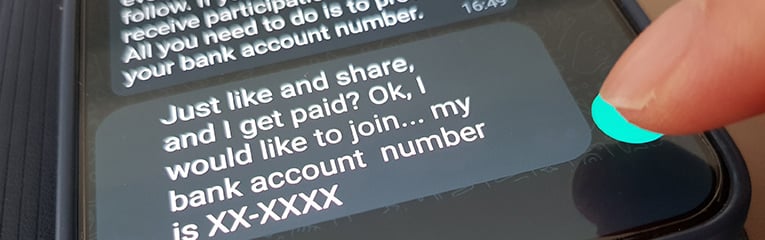

Scammers often pose as "influencers" asking you to promote a product or service, or as a legitimate employer with an enticing job offer for a “small fee.” The scam, which usually sounds too good to be true, is advertised in way so that their victim becomes emotionally invested.

Here's how it typically plays out:

- The Bait: The scammer sends you a check that appears legitimate, often featuring a well-known company's logo and official-looking details.

- The Deposit: You’re instructed to deposit the check into your account. Initially, the check clears, and the funds become available in your account. This is where many victims are lulled into a false sense of security.

- The Request: The scammer asks you to send a portion of the money back via Cash App, Venmo, PayPal, or cryptocurrency, to cover service fees or pay for training supplies.

- The Trap: The check is returned, the victim’s account is drained, and the scammer is gone, leaving the victim on the hook to pay back the financial institution.

Red Flags to Watch Out For

Scammers are sly, conniving, and extremely convincing. They're skilled at making offers look and sound legitimate, but there are several warning signs you can identify to help you spot a fake check scam before it's too late.

- Unsolicited Offers: If someone contacts you with a job offer or money-making opportunity, be cautious, especially if it seems too good to be true.

- Pressure to Act Quickly: Scammers often push you to deposit the check and send the money quickly before your financial institution has time to verify the check’s authenticity.

- Request for a Return Payment: Any time you’re asked to deposit a check and then send money back, it’s a major red flag. Legitimate employers or companies will never ask you to do this.

- Poor Communication: Be wary of poorly written messages, strange email addresses, or inconsistent communication from the person offering the opportunity.

- Vague Job Descriptions: Scammers often provide little detail about the job or why you’re being sent a check. If the instructions are unclear or seem unnecessary, it’s likely a scam.

How to Protect Yourself from Fake Check Scams

Avoiding fake check scams on social media requires vigilance and a healthy dose of skepticism. Here’s how you can protect yourself.

- Verify the Source: Before accepting any job offer or money-making opportunity, research the person or company contacting you. Look up their official website, check for reviews, and contact them directly using verified contact information.

- Ask Questions: Scammers often crumble under scrutiny. Ask detailed questions about the job, payment process, and why you’re being asked to handle money. Legitimate opportunities will provide clear, logical answers.

- Never Agree to Send Money Back: If someone asks you deposit a check into your account and send money back to them, refuse. It’s a clear sign of a scam.

- Verify the Check: If you believe you received a legitimate check, bring it to your financial institution and ask them to help you verify the source. Explain to them why you received it and what instructions you were given before depositing it into your account.

- Keep Personal Information Private: Don’t share your checking or savings account details, address, or other sensitive information with strangers on social media.

What to Do if You Get Scammed

If you find yourself caught in a scam, be sure to do these things immediately.

- Report the user to the social media platform being used and the specific payment app involved immediately.

- If you shared account information, credit or debit card numbers, online banking username or password, alert your financial institution so they can take steps to protect you from further loss.

- File a report with the FBI and Federal Trade Commission which helps the federal government keep track of trends and aids in any potential prosecution efforts.

- Notify local law enforcement and file a police report.

Staying Safe on Social Media

Social media is a powerful tool, but it’s also a digital hunting ground for scammers. To stay safe, follow these guidelines.

- Be Skeptical of Offers: If something sounds too good to be true, it probably is. Always double-check offers, especially those involving money.

- Adjust Privacy Settings: Limit who can see your posts and personal information on social media. The less information scammers have, the harder it is for them to target you.

- Report Suspicious Activity: If you encounter a scam or suspicious offer, report it to the social media platform immediately. This helps protect others from falling victim.

- Educate Yourself: Knowledge is your best defense against fraud. Stay informed about common scams and how they evolve. For additional information about social media scams, check out our “Social Media: Connections, Community, and a Hub for these 5 Common Scams.”

Please remember, neither Peach State nor any of our third-party vendors (i.e., Visa) will ever call, text, or email you asking you to disclose account or other personal information. If you believe you were contacted by someone pretending to be from Peach State, don’t respond and contact us immediately at 855.889.4328, stop by your local branch, or email us at psfcu@peachstatefcu.org.

To learn more about how you can further protect yourself from fraud and scams, visit the Fraud Prevention section on our website.